Introduction

Ever thought about trading stocks without risking your real money? That’s exactly where the Investopedia Simulator comes into play. It offers a risk-free environment where you can buy, sell, and manage stocks just like you would in a real market. But why is this important?

In today’s financial world, understanding how markets work is crucial. Whether you’re a student, a beginner investor, or someone looking to improve their trading skills, the simulator gives you hands-on experience. It allows you to apply theories, test strategies, and watch the outcomes in real-time. Think of it as flight school for future traders.

And let’s face it, theory alone doesn’t cut it. The best way to learn is by doing. The Investopedia Simulator bridges the gap between reading about investing and actually doing it. So if you’re new to trading, this is the perfect sandbox for you.

What Is the Investopedia Simulator?

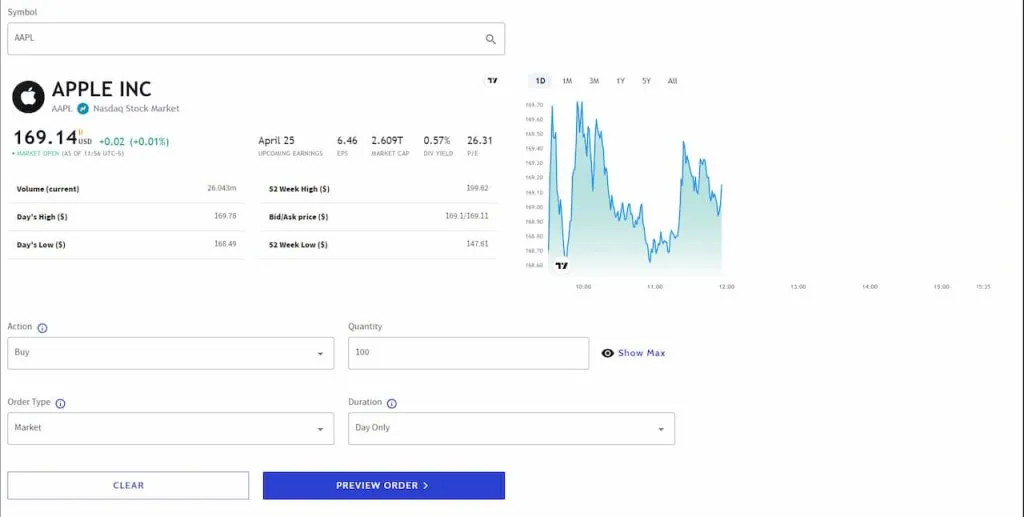

The Investopedia Simulator is an educational tool designed to mimic the real-world stock market. It provides users with virtual money—typically $100,000 in a paper trading account—that they can use to buy and sell stocks, ETFs, options, and more. It includes real-time data, performance tracking, and even social features.

This isn’t just a video game version of investing. The platform is structured to reflect actual market behavior, including price fluctuations, order types, commissions, and trading hours. It mirrors the kind of trading experience you’d get with an online broker.

Users can create private or public games, join others, or practice solo. Whether you want to challenge your friends or learn solo, the simulator accommodates all kinds of learners. Plus, the dashboard includes detailed analytics and performance graphs to track how well you’re doing.

Signing Up: Your First Step into Virtual Trading

Getting started is simple. Head over to the Investopedia Simulator website and sign up for a free account. Once registered, you’re given virtual money to begin trading. The interface is user-friendly, making it easy for anyone to start investing right away.

After signing up, you can join pre-existing public games or create your own. This is great for classroom environments, investment clubs, or even friends who want to compete. The signup process doesn’t require any banking info, which makes it completely safe for learners.

From there, you customize your game settings like game length, rules, and starting cash. This helps in creating realistic trading scenarios tailored to your learning needs. It’s your lab for financial experiments, so tweak it how you see fit.

Key Features of the Investopedia Simulator

One standout feature of the simulator is real-time trading data. This helps users understand how market news affects stock prices in the moment. Unlike fantasy stock games, this one incorporates actual trading mechanics.

Another great feature is the use of different order types: market orders, limit orders, stop-loss orders, and more. These features teach users how to protect profits and minimize risks. It’s not just about buying low and selling high; it’s about learning risk management too.

You also get access to performance tracking tools. These tools show your portfolio performance over time and compare it with others. This not only builds competitiveness but helps you understand your growth as an investor.

Learning by Doing: Educational Benefits

The simulator is more than a game. It’s a learning environment. For students, it provides practical exposure to market dynamics. For educators, it’s a tool to teach financial literacy interactively.

It enhances understanding of financial concepts like diversification, volatility, and leverage. Textbooks might tell you what a diversified portfolio looks like, but with the simulator, you actually build one and see how it reacts over time.

Additionally, the platform helps develop analytical thinking. Users start recognizing patterns and understanding the impact of external events (like news releases or earnings reports). You start to think like a real investor.

Strategy Testing: Trial Without Error

One of the best uses of the Investopedia Simulator is testing strategies. Whether it’s value investing, growth investing, or day trading, you can apply your theories without risking a cent. This lets you refine your approach before stepping into the real world.

Have a new strategy in mind? Test it during different market conditions: bull, bear, or sideways. You can even simulate scenarios like interest rate hikes or market crashes to see how your portfolio holds up.

What’s more, you can analyze each move using historical data and charts. These insights are crucial for improving your timing and decision-making skills. Over time, your trading becomes more calculated and less emotional.

Community and Competitions

A key benefit of the simulator is the social element. Public games allow you to compete with other users globally. This adds a layer of excitement and motivation. You get to learn from others, compare strategies, and see where you stand.

There are also leaderboards that rank top performers. investopedia simulator This helps build a competitive spirit and encourages consistent improvement. If you’re a teacher, you can track how your students are performing in a private game.

The forums and comment sections allow for discussion and feedback. This sense of community creates a collaborative learning experience. You’re not just trading in isolation; you’re part of a network of aspiring investors.

Classroom Integration: A Teacher’s Dream Tool

Educators are always looking for ways to make learning stick. The Investopedia Simulator is a perfect classroom companion. It allows teachers to create custom games tailored to course objectives. Students get hands-on experience in financial management.

Assignments can be created around real-time data, current events, or specific investment themes. This helps students connect theory with practical applications. Plus, teachers can monitor student progress and provide individualized feedback.

It also supports interdisciplinary learning. Economics, math, and even psychology can be explored through the lens of trading. This creates a more holistic educational experience.

Pitfalls and Limitations

While the simulator is an incredible tool, it’s not perfect. One of its biggest limitations is emotional detachment. Since you’re trading fake money, investopedia simulator it doesn’t replicate the stress and emotional highs and lows of real investing.

Additionally, some users may develop bad habits, like overtrading or taking extreme risks, because there’s no financial consequence. These habits can be dangerous if carried into real markets.

Another minor issue is the data feed. While mostly accurate, there can be occasional lags in real-time pricing. This might affect the realism of some trades, investopedia simulator especially in fast-moving markets.

Tips to Maximize Your Experience

To get the most out of the simulator, treat it like real investing. Set realistic goals, research before trading, and diversify your portfolio. investopedia simulator Keep a journal of your trades and review what went right or wrong.

Don’t chase leaderboards blindly. Focus on learning, not just winning. Understand why a stock went up or down, and how your strategy played out. This turns each trade into a lesson.

Lastly, gradually introduce complexity. Start with basic stocks, then move on to ETFs, options, and advanced order types. Building knowledge step-by-step leads to better retention and confidence.

Transitioning to Real Trading

Once you’ve built confidence on the simulator, you might be tempted to start real investing. That’s great—but proceed with caution. Use what you’ve learned to choose a reputable brokerage and start small.

Remember, the emotions are different when real money is on the line. Start with a small portfolio and apply the same discipline you used in the simulator. Review your real trades regularly, just like you did in the virtual world.

Also, continue learning. The market evolves, and so should your strategies. Keep testing new ideas on the simulator even after you start real trading. Think of it as your permanent training ground.

Final Thoughts: Practice Makes Profit

The Investopedia Simulator is one of the most powerful, user-friendly platforms for learning the stock market. Whether you’re just starting out or want to refine your skills, it offers a robust, realistic environment to grow.

It allows you to make mistakes, test ideas, and build confidence—all without losing a dime. For students, hobbyists, and even educators, it’s an invaluable resource. In the financial world, knowledge is profit, and the simulator is your key to gaining both.

So what are you waiting for? Dive into the Investopedia Simulator today and start mastering the market, one virtual trade at a time.